Understanding Key Sustainability Reporting Frameworks: A Guide for Organizations

In today's increasingly interconnected and environmentally conscious world, sustainability reporting has become a crucial aspect of responsible business practices. Organizations are under growing pressure from stakeholders, including investors, customers, and regulators, to be transparent about their environmental, social, and governance (ESG) performance. While the need for sustainability reporting is clear, navigating the complex landscape of frameworks and standards can be challenging. This guide aims to provide a comprehensive overview of three key sustainability reporting frameworks: the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-Related Financial Disclosures (TCFD). Understanding these frameworks is essential for organizations seeking to communicate their sustainability performance effectively, build stakeholder trust, and contribute to a more sustainable future.

The Global Reporting Initiative (GRI) Framework

The Global Reporting Initiative (GRI) framework is one of the most widely used standards for sustainability reporting. It provides a comprehensive set of guidelines for organizations to measure and report their environmental, social, and governance (ESG) performance. Here's a detailed overview of the GRI framework:

Overview of GRI

History: The GRI was founded in 1997 by the Coalition for

Environmentally Responsible Economies (CERES) and the United Nations

Environment Programme (UNEP). It was created to develop a standardized

framework for sustainability reporting that could be used globally by

organizations of all types and sizes.

Mission: The mission of GRI is to enable organizations to be

transparent about their impacts on the environment, society, and economy, and

to hold them accountable for their actions. The GRI framework helps

organizations report on their sustainability practices in a consistent and

comparable way.

1. Key Features of the GRI Framework

Universality: GRI is designed to be applicable to

organizations of all sizes and industries, from small businesses to

multinational corporations.

Materiality: The framework emphasizes the importance of

reporting on issues that are most significant to the organization's stakeholders.

This means that companies should focus on disclosing information that is

relevant to their specific context and impacts.

Stakeholder Inclusivity: GRI encourages organizations to

engage with their stakeholders to understand their expectations and priorities.

This helps ensure that the sustainability report meets the needs of various

audiences.

Transparency: The framework promotes transparency by

requiring organizations to disclose information in a clear and consistent

manner. This helps stakeholders assess the organization's sustainability

performance and make informed decisions.

2. Structure of the GRI Framework

GRI Standards: The GRI framework is structured around a set

of modular, interrelated standards that organizations can use to report on

specific topics. These standards are divided into three main categories:

Universal Standards: These apply to all organizations and

cover the core aspects of sustainability reporting. They include:

GRI 1: Foundation: Provides the principles for using the GRI

Standards and explains how to report in accordance with the standards.

GRI 2: General Disclosures: Covers information about the

reporting organization, its practices, and its material topics.

GRI 3: Material Topics: Guides organizations on how to

identify and report on material topics, which are the most significant issues

for their stakeholders.

Topic-Specific Standards: These standards focus on specific

sustainability topics and are divided into three main categories:

Economic Standards: These include standards related to

economic performance, market presence, anti-corruption, procurement practices,

and more (e.g., GRI 201: Economic Performance, GRI 205: Anti-corruption).

Environmental Standards: These cover issues related to the

environment, such as energy, water, biodiversity, emissions, waste, and

environmental compliance (e.g., GRI 302: Energy, GRI 305: Emissions).

Social Standards: These address social issues, including

labor practices, human rights, diversity, health and safety, and community

impacts (e.g., GRI 401: Employment, GRI 403: Occupational Health and Safety,

GRI 413: Local Communities).

Sector Standards: These are tailored to specific industries,

addressing unique sustainability challenges and opportunities within particular

sectors, such as oil and gas, agriculture, and financial services.

3. Principles of Reporting

The GRI framework is guided by several key principles that

ensure the quality and credibility of the sustainability report:

Materiality: Organizations should focus on reporting issues

that are significant to their stakeholders and have a substantial impact on

their economic, environmental, and social performance.

Stakeholder Inclusiveness: Organizations should identify and

engage with their stakeholders, and consider their expectations and interests

in the reporting process.

Sustainability Context: The report should present the

organization's performance in the broader context of sustainability,

considering how its actions contribute to or detract from sustainable

development.

Completeness: The report should cover all material aspects

of the organization's performance and provide sufficient information for

stakeholders to assess the organization's sustainability performance.

Accuracy, Balance, Clarity, Comparability, and Timeliness:

These principles ensure that the information reported is reliable, unbiased,

easily understandable, consistent with previous reports, and delivered in a

timely manner.

4. Reporting Process

Identifying Material Topics: The first step in the GRI

reporting process is identifying the material topics, which are the most

significant sustainability issues for the organization and its stakeholders.

This typically involves stakeholder engagement and a materiality assessment.

Data Collection and Analysis: Organizations collect data

related to the identified material topics, analyze their performance, and

prepare disclosures in line with the relevant GRI Standards.

Preparing the Report: The sustainability report is then

prepared, following the GRI Standards. It should include a description of the

organization's governance, strategy, and management approach, as well as

detailed disclosures on material topics.

Assurance and Verification: While not mandatory,

organizations are encouraged to have their sustainability reports externally

assured to enhance credibility and stakeholder trust.

Publishing and Communication: Finally, the report is

published and communicated to stakeholders. The organization can choose to

report in accordance with the GRI Standards at two levels: Core (basic level of

disclosures) or Comprehensive (more detailed and extensive disclosures).

For example, Nestlé is committed to transparency and

sustainability. The company's sustainability reports are structured according

to GRI guidelines, providing detailed information on their sustainability

initiatives, environmental impact, and social responsibility efforts. Samsung Electronics also follows the GRI

framework in its sustainability reporting. Their reports include GRI indicators

related to energy efficiency, product sustainability, labor practices, and

community engagement.

Sustainability

Accounting Standards Board (SASB)

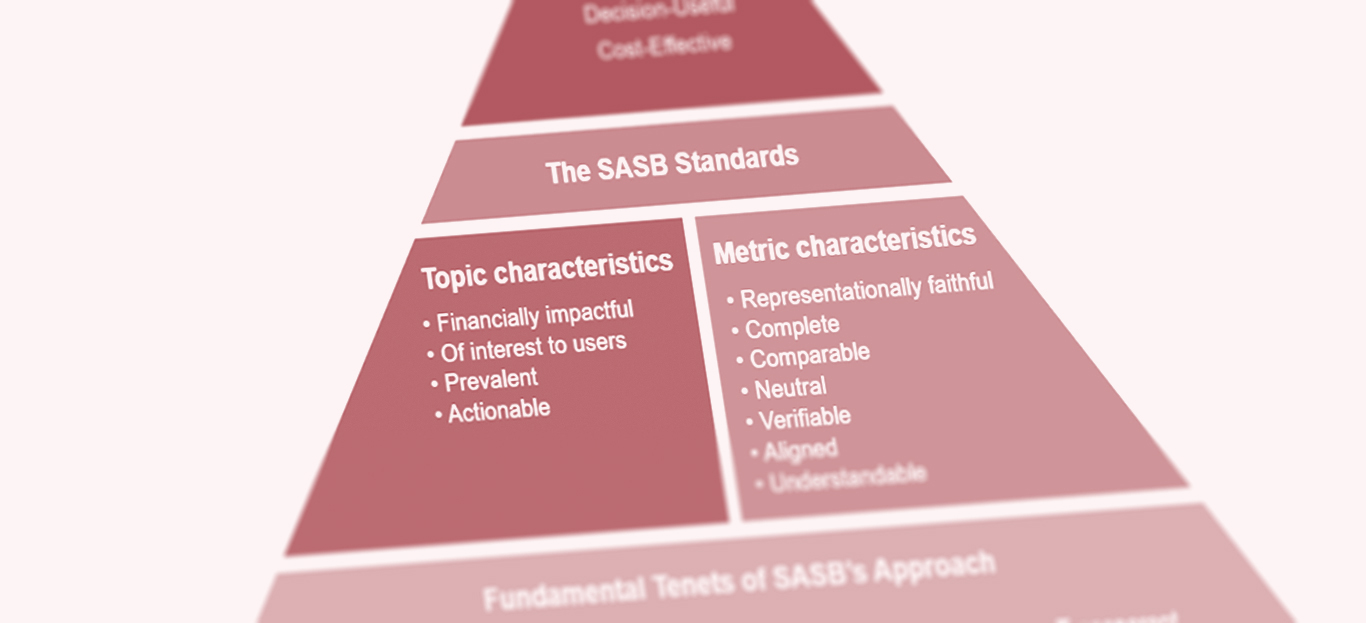

The SASB framework is another prominent tool for sustainability reporting, particularly focused on financial materiality and investor needs. Here's a detailed overview of the SASB framework:

1. Overview of SASB

History: The SASB was founded in 2011 as an

independent non-profit organization to develop and maintain sustainability

accounting standards. It aims to provide investors and companies with a common

language for communicating financially material sustainability information.

Mission: The mission of SASB is to help businesses

around the world identify, manage, and report on the sustainability topics that

are likely to impact financial performance. SASB standards are designed to be

cost-effective for companies to implement while providing investors with

decision-useful information.

2. Structure of the SASB Framework

Industry-Specific Standards: SASB provides sustainability

accounting standards for 77 industries across 11 sectors. These standards are

tailored to the unique sustainability challenges and opportunities within each

industry. For example, the sustainability issues relevant to the financial

sector differ significantly from those in the energy sector.

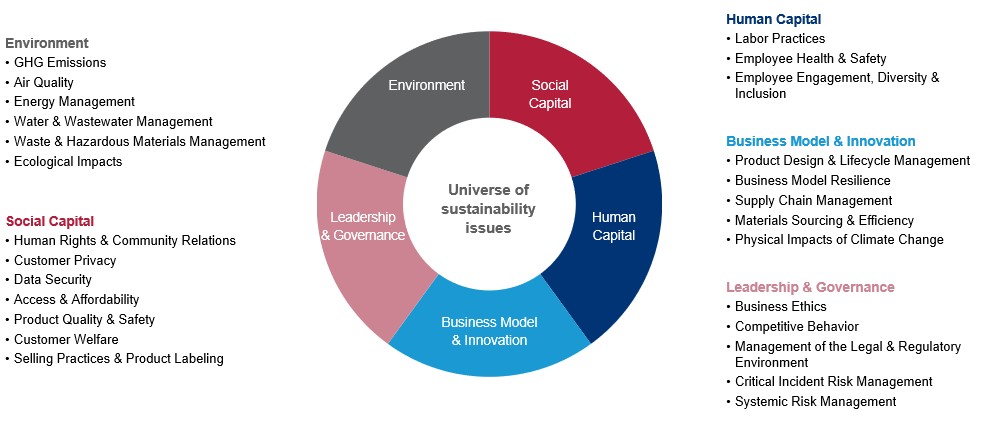

Five Sustainability Dimensions: SASB standards are organized

into five broad sustainability dimensions that capture the main ESG issues

affecting financial performance:

Environment: This dimension includes issues like greenhouse

gas emissions, air quality, energy management, water and wastewater management,

and waste and hazardous materials management.

Social Capital: This dimension covers topics related to a

company’s impact on society and its stakeholders, such as customer privacy,

data security, product quality and safety, and access to essential services.

Human Capital: This includes issues related to labor

practices, employee health and safety, diversity and inclusion, and workforce

development.

Business Model & Innovation: This dimension addresses

how companies integrate sustainability into their business models and

innovation processes. It covers topics like product design and lifecycle

management, supply chain management, and physical impacts of climate change.

Leadership & Governance: This dimension focuses on governance-related issues such as business ethics, anti-competitive behavior, risk management, and systemic risk.

3. Materiality Focus

Financial Materiality: SASB's key differentiator is its

focus on financial materiality. The standards are designed to help companies

disclose sustainability information that is likely to impact their financial

condition or operating performance. This focus aligns SASB with the needs of

investors, who seek financially relevant ESG information for making informed

investment decisions.

Industry-Specific Approach: The framework’s industry-specific approach ensures that companies report on the most relevant sustainability issues for their sector, making the information more actionable and comparable for investors.

4. Principles of Reporting

SASB standards are based on a set of guiding principles to ensure that the reported information is useful for investors:

Fair Representation: Disclosures should accurately represent the company's sustainability performance and be free from bias.

Completeness: Companies should provide all the information

necessary to understand their sustainability-related risks and opportunities.

Verifiability: Disclosures should be based on reliable data

and processes, allowing for independent verification.

Consistency: Companies should ensure that disclosures are

consistent over time to enable trend analysis and comparability.

Neutrality: Information should be presented in a way that is

free from bias, enabling investors to make informed decisions.

5. Reporting Process

Materiality Assessment: Organizations using SASB standards

begin by conducting a materiality assessment to identify the sustainability

issues that are most likely to affect their financial performance. SASB

provides guidance on materiality for each industry.

Data Collection and Disclosure: Companies then collect data

on the identified material issues and prepare disclosures in line with the SASB

standards. The framework provides specific metrics and disclosure topics for

each industry, making it easier for companies to report consistent and

comparable information.

Integration with Financial Reporting: SASB encourages

companies to integrate their sustainability disclosures with their financial

reporting, such as in annual reports or 10-K filings. This integration reflects

the financial materiality of the disclosed information and aligns with investor

expectations.

For example, Nike follows the SASB framework in its

sustainability reporting efforts. The company reports on material

sustainability topics such as labor practices, product innovation, responsible

sourcing, and climate impact, aligning with SASB standards. Microsoft Corporation also incorporates SASB

standards into its sustainability reporting practices. The company discloses

information on environmental impact, data privacy, cybersecurity, and diversity

and inclusion, in line with SASB guidelines.

The SASB framework provides a powerful tool for companies to

disclose financially material sustainability information that is relevant to

their industry. By focusing on financial materiality and industry-specific

issues, SASB helps companies provide investors with the information they need

to make informed decisions. This approach not only supports better investment

outcomes but also encourages companies to manage sustainability risks and

opportunities more effectively.

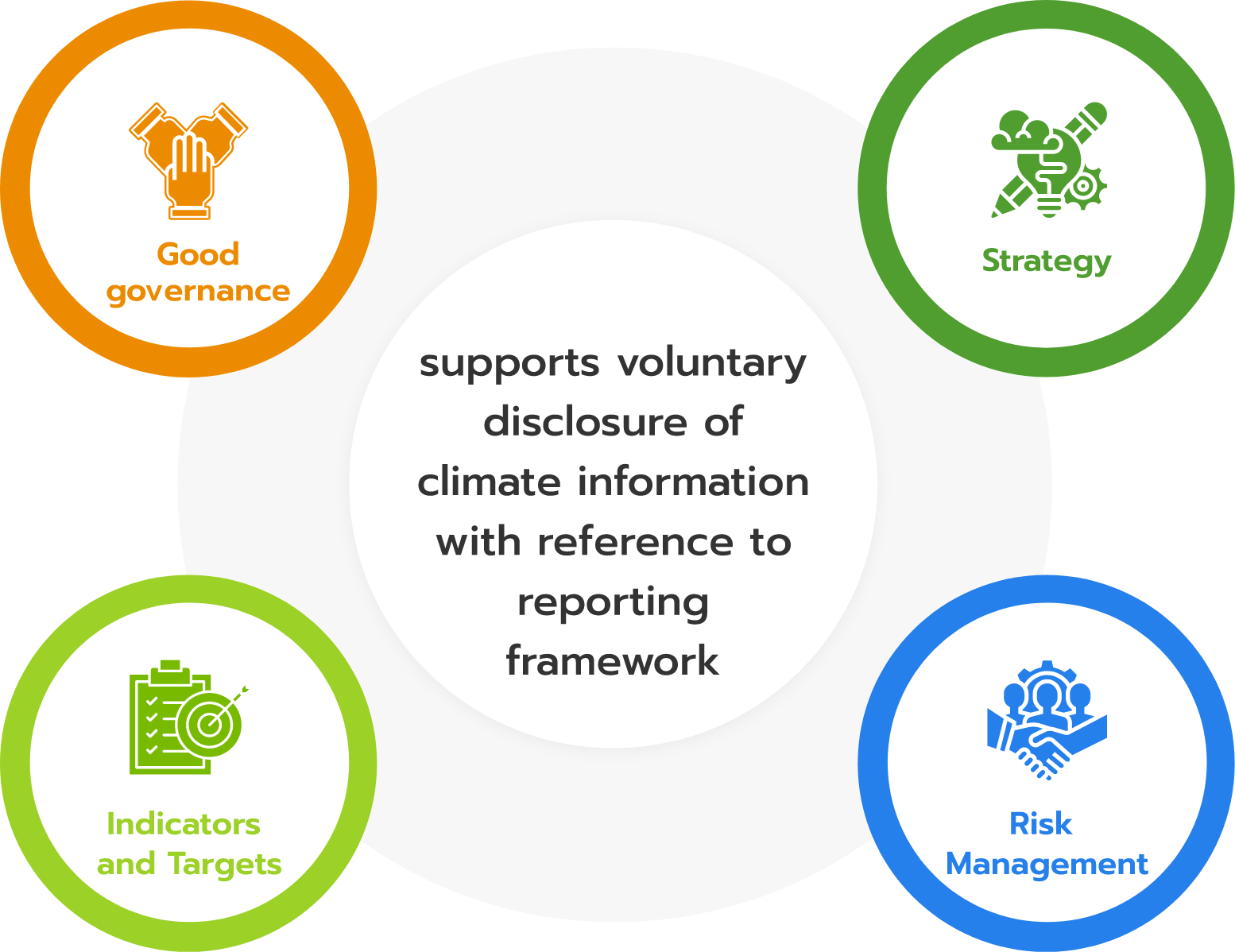

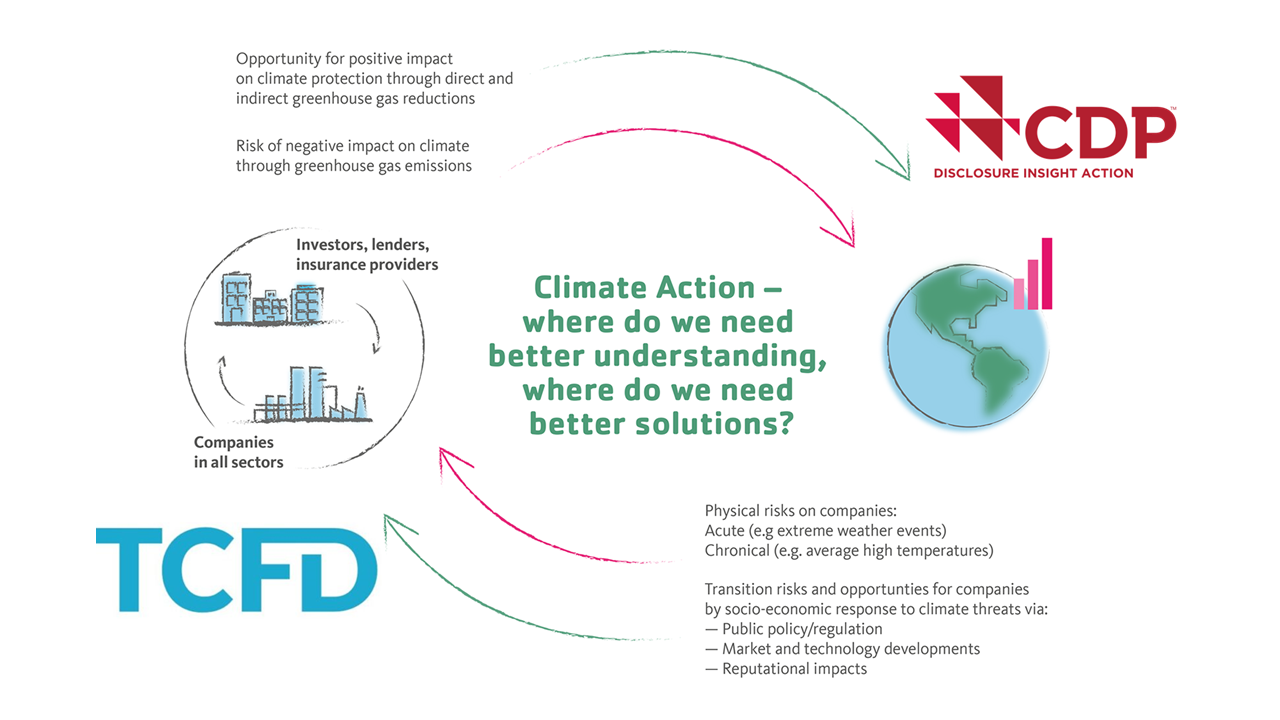

Task Force on Climate-related Financial Disclosures (TCFD)

The TCFD is a globally recognized framework that provides recommendations for disclosing climate-related financial risks and opportunities. Established by the Financial Stability Board (FSB) in 2015, the TCFD framework is designed to help organizations provide more transparent and consistent climate-related financial information to investors, lenders, insurers, and other stakeholders.

1. Overview of TCFD

History: The TCFD was established in December 2015 by the Financial Stability Board, an international body that monitors and makes recommendations about the global financial system. The task force was chaired by Michael Bloomberg and included experts from various sectors, including finance, industry, and academia.

Mission: The TCFD’s mission is to develop consistent

climate-related financial risk disclosures for use by companies, banks, and

investors in providing information to stakeholders. The ultimate goal is to

improve and increase reporting of climate-related financial information and to

foster more informed investment, credit, and insurance underwriting decisions.

2. Structure of the TCFD Framework

The TCFD framework is built around four core elements that

represent the essential aspects of how organizations operate and report on

climate-related issues:

Governance: This element focuses on the organization’s governance around climate-related risks and opportunities.

Key Disclosures:

- The board’s oversight of climate-related risks and opportunities.

- Management’s role in assessing and managing these risks and opportunities.

Strategy: This element addresses the actual and potential

impacts of climate-related risks and opportunities on the organization’s

businesses, strategy, and financial planning.

Key Disclosures:

- The climate-related risks and opportunities the organization has identified over the short, medium, and long term.

- The impact of these risks and opportunities on the organization’s businesses, strategy, and financial planning.

- How climate-related issues are incorporated into the organization’s strategic planning.

Risk Management: This element focuses on how the

organization identifies, assesses, and manages climate-related risks.

Key Disclosures:

- The processes for identifying and assessing climate-related risks.

- The processes for managing climate-related risks.

- How these processes are integrated into the organization’s overall risk management.

Metrics and Targets: This element deals with the metrics and

targets used to assess and manage relevant climate-related risks and

opportunities.

Key Disclosures:

- The metrics used to assess climate-related risks and opportunities in line with the organization’s strategy and risk management process.

- The targets used to manage climate-related risks and opportunities, and performance against those targets.

- Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks.

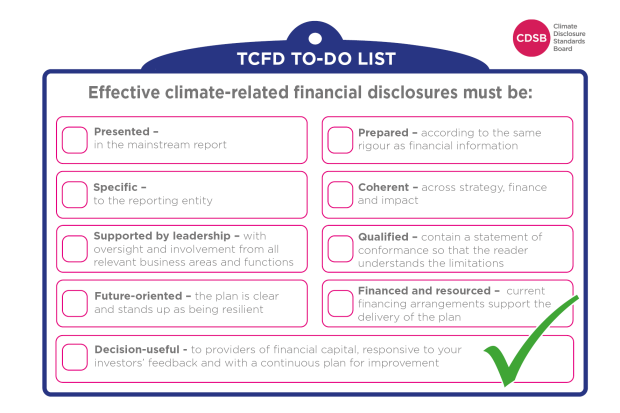

3. Principles for Effective Disclosure

The TCFD provides several principles to guide organizations

in developing high-quality climate-related financial disclosures:

Disclosures Should Represent Relevant Information: The

information disclosed should be specific and detailed enough to enable

investors to understand the climate-related risks and opportunities facing the

organization.

Disclosures Should Be Specific and Complete: Disclosures

should provide sufficient detail to enable users to assess the organization’s

exposure to, and management of, climate-related risks and opportunities.

Disclosures Should Be Clear, Balanced, and Understandable:

The information should be presented in a manner that is understandable to

investors, lenders, insurers, and other stakeholders.

Disclosures Should Be Consistent Over Time: The information

should be presented in a consistent manner over time to allow for

comparability.

Disclosures Should Be Comparable Among Companies Within a

Sector, Industry, or Portfolio: The disclosures should allow for meaningful

comparisons of climate-related risks and opportunities across organizations.

4. Scenario Analysis

Purpose: A key aspect of the TCFD framework is the use of scenario analysis to assess the potential impact of different climate-related scenarios, including a scenario consistent with a 2°C or lower increase in global temperatures. Scenario analysis helps organizations understand the range of possible outcomes and the strategic implications of climate change.

Implementation: Organizations are encouraged to describe how resilient their strategies are under various plausible climate-related scenarios, including transition risks (e.g., regulatory changes, market shifts) and physical risks (e.g., extreme weather events).

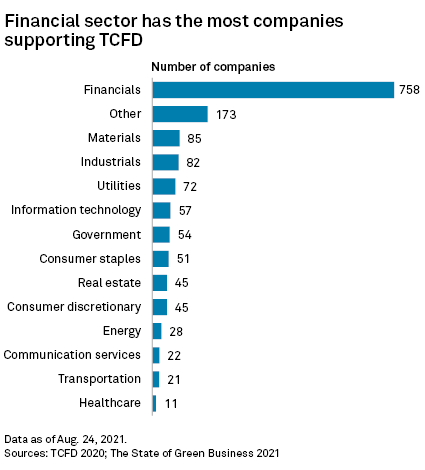

5. Adoption and Implementation

Global Reach: Since its recommendations were published in 2017, the TCFD framework has been widely adopted by organizations globally, including public companies, financial institutions, and regulators. Many governments and financial regulators now require or recommend TCFD-aligned disclosures.

Voluntary Disclosure: The TCFD framework is voluntary, but

its adoption is encouraged by investors and other stakeholders. Companies

across various sectors, especially those with significant climate-related

exposure, are increasingly aligning their disclosures with TCFD

recommendations.

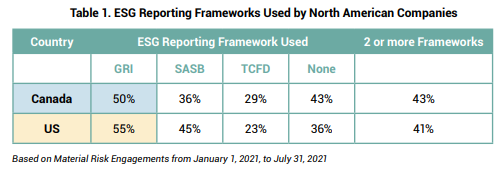

Integration with Other Frameworks: The TCFD framework

is often used in conjunction with other sustainability reporting frameworks,

such as the GRI and SASB, providing a comprehensive approach to ESG reporting.

The TCFD’s focus on climate-related financial risks complements the broader ESG

issues covered by these frameworks.

Challenges in Implementation: While the TCFD framework has

gained traction, organizations often face challenges in implementing its

recommendations, particularly in conducting scenario analysis and integrating

climate-related risks into existing risk management processes.

The TCFD framework provides a robust, investor-focused approach to disclosing climate-related financial risks and opportunities. By following the TCFD recommendations, organizations can enhance their transparency, improve their risk management, and demonstrate their commitment to addressing climate change. The framework’s emphasis on scenario analysis, governance, and integration with financial reporting makes it a critical tool for organizations navigating the financial implications of climate change.

Differences between GRI, SASB and TCFD

Comparing the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD) frameworks reveals key differences in their focus, audience, and approach to sustainability reporting. Each framework offers unique strengths, and selecting the most suitable one depends on a company’s specific needs, industry, and reporting objectives. Here’s a detailed comparison of these three frameworks:

1. Purpose and Focus

GRI: The GRI framework is designed for comprehensive

sustainability reporting across a wide range of environmental, social, and

governance (ESG) topics. It encourages organizations to disclose their impacts

on the economy, environment, and society, with a focus on broad stakeholder

engagement. The GRI is ideal for organizations seeking to provide a holistic

view of their sustainability performance and their contributions to sustainable

development.

SASB: SASB focuses specifically on financially material

sustainability issues that are most likely to impact a company’s financial

performance. It offers industry-specific standards for 77 industries, making it

highly tailored to the financial aspects of sustainability reporting. SASB is

particularly useful for companies looking to provide investors with

decision-useful ESG information that directly affects financial outcomes.

TCFD: The TCFD framework is centered on disclosing

climate-related financial risks and opportunities. Its primary goal is to

provide consistent and comparable information to investors, lenders, insurers,

and other stakeholders about how climate change might impact a company’s

financial health. TCFD is especially relevant for organizations that need to

address the financial implications of climate change within their risk

management and strategic planning processes.

2. Audience and Users

GRI: The GRI framework is designed for a broad range of

stakeholders, including investors, customers, employees, regulators, and the

general public. It emphasizes transparency and accountability, making it

suitable for organizations that aim to communicate their sustainability impacts

to a diverse audience.

SASB: SASB’s primary audience is investors and financial

market participants. The standards are designed to meet the needs of those who

require financially material ESG information to make informed investment

decisions. Companies focused on attracting and retaining investment based on

their sustainability performance may find SASB particularly beneficial.

TCFD: The TCFD framework is geared towards financial market

participants, including investors, lenders, and insurers, as well as

regulators. It provides insights into how climate-related risks and

opportunities are likely to affect an organization’s financial stability.

Companies that are particularly exposed to climate-related risks or that

operate in sectors sensitive to climate change may prioritize TCFD disclosures.

3. Reporting Approach

GRI: GRI offers a modular, flexible approach with Universal

Standards, Topic-Specific Standards, and Sector Standards. Organizations can

choose to report in accordance with GRI at either the Core or Comprehensive

level, depending on the depth of their disclosures. The GRI approach emphasizes

stakeholder inclusiveness, materiality, and sustainability context.

SASB: SASB provides industry-specific standards, with

predefined metrics and disclosure topics that focus on the most material ESG

issues for each sector. SASB encourages integration with financial reporting

and aligns closely with traditional financial disclosures, making it easier for

companies to report ESG information alongside their financial results.

TCFD: TCFD’s approach is structured around four core

elements: Governance, Strategy, Risk Management, and Metrics & Targets. It

emphasizes scenario analysis to assess the potential impact of climate-related

risks and opportunities under different climate scenarios. TCFD encourages

organizations to integrate climate-related financial disclosures with their

overall risk management and strategic planning processes.

4. Materiality

GRI: Materiality in the GRI framework is determined by

considering the significance of an organization’s impacts on the economy,

environment, and society, as well as stakeholder concerns. It’s a broader

concept that goes beyond financial materiality to include impacts on various

stakeholders.

SASB: SASB focuses on financial materiality, meaning that

the standards highlight ESG issues that are likely to affect a company’s

financial performance. This narrow focus on financial outcomes makes SASB

particularly relevant for companies that need to align their sustainability

reporting with investor expectations.

TCFD: TCFD also emphasizes financial materiality but within

the context of climate-related risks and opportunities. The framework

encourages companies to consider how climate change might materially impact

their financial position, including revenues, costs, and capital expenditures.

5. Global Adoption and Regulation

GRI: GRI is globally recognized and widely used by

organizations of all sizes and sectors. It is often required or recommended by

governments and regulators around the world, particularly in regions where

comprehensive ESG reporting is mandated.

SASB: While SASB originated in the United States, it has

gained global traction, particularly among publicly traded companies. Its focus

on investor needs aligns well with the increasing demand for ESG information in

financial markets.

TCFD: TCFD is becoming increasingly influential, with many governments and regulators either recommending or mandating TCFD-aligned disclosures. Its global adoption is driven by the growing recognition of climate change as a financial risk.

6. Integration with Other Frameworks

GRI: GRI can be used in conjunction with other frameworks, such as SASB and TCFD, to provide a more comprehensive view of an organization’s sustainability performance. GRI’s broad scope allows for the integration of more focused standards.

SASB: SASB can complement other frameworks, particularly

when companies want to provide both broad ESG disclosures (using GRI) and

financially material information (using SASB). It also aligns well with TCFD

for climate-related financial disclosures.

TCFD: TCFD is often used alongside other frameworks like GRI

and SASB, especially for companies that need to disclose climate-related

financial risks within a broader ESG context.

Guidance for Companies

Broad Stakeholder Engagement: If your company aims to engage

a wide range of stakeholders and provide a comprehensive view of your

sustainability impacts, the GRI framework may be the best fit. It allows for a

holistic approach to ESG reporting, emphasizing transparency and

accountability.

Investor-Focused Reporting: If your company’s primary goal

is to communicate financially material ESG information to investors,

particularly within an industry-specific context, the SASB framework is likely

the most appropriate. It aligns well with financial reporting and provides

investors with decision-useful information.

Climate-Related Financial Risks: For companies that are

particularly exposed to climate-related risks or that operate in sectors

sensitive to climate change, the TCFD framework should be a key consideration.

Its focus on governance, strategy, and risk management around climate issues

provides valuable insights to investors and regulators.

Comments

Post a Comment