Why Sustainability Reporting Matters: A Guide for Businesses

In today's interconnected world, where businesses operate within a complex web of stakeholders and environmental realities, sustainability reporting has emerged as a critical tool for responsible and transparent operations. Sustainability reporting goes beyond simply documenting a company's environmental and social impacts; it's about actively engaging with stakeholders, demonstrating accountability, and building a more sustainable future.

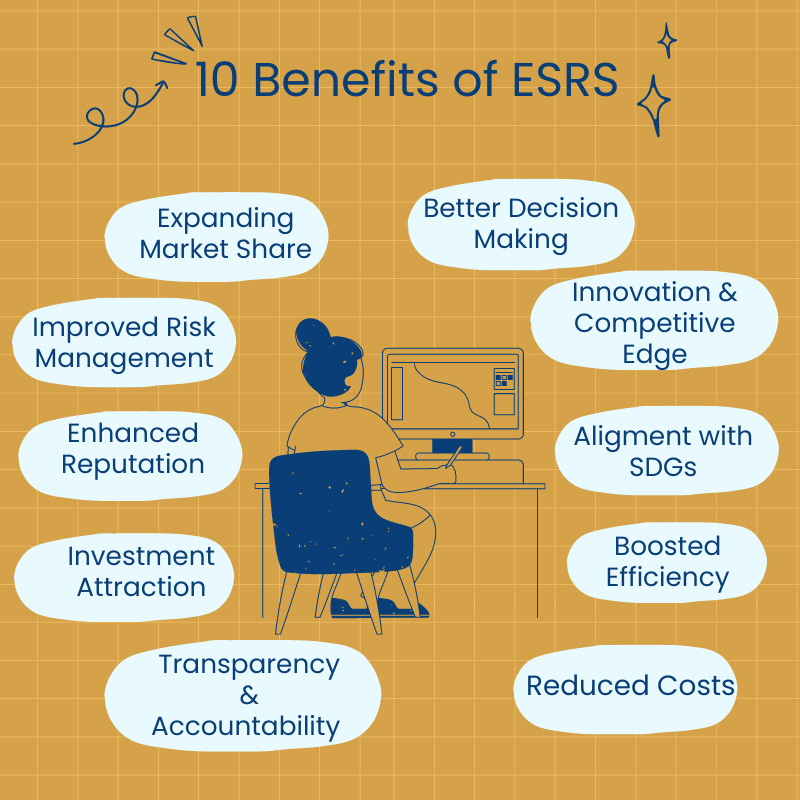

The Business Case for Sustainability Reporting

Financial Benefits

Access to Capital: Investors are increasingly looking for

companies with strong ESG performance. Sustainability reporting can help

companies attract capital from impact investors and socially responsible

investment funds. Impact investors, who

prioritize investments that generate both financial returns and positive social

and environmental impact, are actively seeking companies with strong

sustainability performance. A 2019 study by Friede, Busch, and Bassen reviewed over 2,000 empirical studies and found a positive correlation between ESG performance and financial performance, particularly in terms of lower cost of capital. The study suggests that companies with good ESG disclosure are perceived as less risky by lenders, leading to better financing opportunities.

Improved Investor Relations: Investors are increasingly

seeking companies with strong sustainability performance. Sustainability

reporting provides transparency into a company's environmental, social, and

governance (ESG) practices, attracting investors who prioritize long-term value

and responsible investment.

Reduced Costs: Sustainability reporting can help companies

identify opportunities for cost savings, such as reducing energy consumption,

minimizing waste, and improving resource efficiency. The Carbon Disclosure Project (CDP) found that companies with strong environmental disclosure practices often identify opportunities for operational improvements, leading to cost savings. For example, Unilever reported that its sustainability initiatives saved the company over €700 million between 2008 and 2020 by reducing energy, water, and material usage.

Enhanced Risk Management: By proactively identifying and

mitigating environmental and social risks, companies can reduce their exposure

to potential financial losses and legal liabilities. According to a report by the CFA Institute (2020), more than 75% of investors now use ESG metrics in their decision-making process. The report highlights that companies with strong ESG performance tend to have lower volatility and better risk management, making them more attractive to investors.

Improved Supply Chain Management: Sustainability reporting

can help companies assess and manage the sustainability performance of their

suppliers, reducing risks and improving supply chain resilience.

Competitive Advantages

Differentiation: Sustainability reporting can help companies

differentiate themselves from competitors by showcasing their commitment to

sustainability and responsible practices.

Companies that are leaders in sustainability reporting can position

themselves as pioneers and innovators, attracting customers and investors who

appreciate their commitment to responsible business practices. This can create

a positive halo effect, making the company more attractive to talent and

partners.

Enhanced Brand Reputation: Consumers are increasingly

discerning about the companies they support. Sustainability reporting allows

businesses to showcase their commitment to ethical practices and environmental

responsibility, enhancing their brand image and attracting environmentally

conscious customers. Consumers are more

likely to remain loyal to brands that demonstrate a commitment to

sustainability. A study by Ameer and Othman (2012) found that companies with robust sustainability practices had better financial performance, particularly in terms of return on assets (ROA) and return on equity (ROE). By showcasing their efforts through transparent reporting,

companies can build trust and loyalty with their customers, creating a strong

competitive advantage in the long run.

Reduced Risks: Sustainability reporting helps companies

identify and mitigate potential environmental and social risks. By proactively

addressing these risks through responsible practices and transparent reporting,

businesses can minimize potential financial losses, legal liabilities, and

reputational damage. A study by Eccles, Ioannou, and Serafeim (2014) demonstrated that companies with high sustainability performance have lower risks and better operational performance. The study found that these companies are more likely to anticipate regulatory changes and avoid fines or penalties, leading to cost savings.

Innovation: Sustainability reporting can encourage companies

to invest in research and development of innovative products and services that

address environmental and social challenges.

Market Leadership:

Customers are more likely to choose products and services from companies

that demonstrate a commitment to sustainability through transparent reporting.

This can create a strong competitive advantage, especially in industries where

consumers are particularly sensitive to sustainability issues, such as fashion,

food, and technology.

Attracting Talent: In today's competitive job market,

attracting and retaining top talent is crucial. Sustainability reporting

demonstrates a company's commitment to ethical values and social

responsibility, making it more attractive to employees who prioritize working

for purpose-driven organizations.

Social and Environmental Benefits

Positive Impact: Sustainability reporting can help companies

measure and demonstrate their positive impact on society and the environment.

Community Engagement: Sustainability reporting can help

companies build stronger relationships with local communities by engaging them

in sustainability initiatives.

Social Responsibility: Sustainability reporting can help

companies demonstrate their commitment to social responsibility and ethical

business practices.

Additional Considerations

Transparency and Trust: Sustainability reporting builds

trust with stakeholders by providing transparent information about a company's

environmental and social performance.

Accountability: Sustainability reporting holds companies

accountable for their commitments to sustainability and encourages them to

continuously improve their performance.

Examples

Patagonia: Known for its commitment to environmental

sustainability, Patagonia publishes detailed sustainability reports that

highlight its efforts to reduce its environmental footprint and promote

responsible sourcing. This has helped the company build a passionate customer

base and attract a loyal following of environmentally conscious consumers.

Unilever: Unilever has a long history of sustainability

reporting, outlining its commitment to sustainable sourcing, reducing its

environmental impact, and promoting social responsibility. This has helped the

company gain recognition as a leader in sustainability and attract investors

who prioritize ESG factors.

By effectively communicating their sustainability

performance through transparent and compelling reporting, companies can

differentiate themselves from competitors, build brand loyalty, and gain a

competitive edge in the marketplace.

The Regulatory Landscape

The growing recognition of sustainability's importance has

led to a surge in regulations and frameworks driving sustainability reporting.

Key frameworks include:

Global Reporting Initiative (GRI)

The Global Reporting Initiative (GRI) is an international,

independent nonprofit organization that provides a comprehensive framework for

sustainability reporting. Established in 1997, GRI's mission is to help

businesses, governments, and other organizations understand and communicate

their environmental, social, and governance (ESG) impacts in a transparent and

standardized manner.

Key Components of the GRI Framework:

Universal Standards: The GRI framework consists of

universal standards that apply to all organizations, regardless of size,

sector, or geographic location. These standards cover essential aspects of

sustainability reporting, including organizational profile, governance structure,

stakeholder engagement, and economic, environmental, and social performance

indicators.

Sector Standards: In addition to universal standards,

GRI offers sector-specific standards tailored to industries with unique

sustainability challenges. These sector standards provide guidance on reporting

issues specific to sectors such as mining, healthcare, finance, and

manufacturing.

Topic-Specific Standards: GRI's framework includes

topic-specific standards that allow organizations to report in-depth on

specific sustainability topics. These topics cover a wide range of areas,

including greenhouse gas emissions, human rights, labor practices,

biodiversity, and product responsibility.

Companies that adopt the GRI framework for sustainability

reporting often experience increased stakeholder trust, improved brand

reputation, and enhanced risk management. GRI reporting is recognized as a best

practice in sustainability disclosure, and organizations using the framework

are seen as leaders in transparent and accountable business practices.

Sustainability Accounting Standards Board (SASB)

The Sustainability Accounting Standards Board (SASB) is a

nonprofit organization founded in 2011 with the goal of developing

industry-specific sustainability accounting standards. SASB's mission is to

establish disclosure standards across environmental, social, and governance

(ESG) topics that facilitate communication between companies and investors

about financially material, decision-useful information.

Key Components of the SASB Framework:

Industry-Specific Standards: SASB focuses on

developing industry-specific standards tailored to the unique sustainability

issues and risks faced by companies in different sectors. These standards

identify the ESG topics most relevant to financial performance in each

industry, providing a clear framework for reporting.

Materiality and Financial Relevance: SASB standards

are designed to address ESG issues that have a material impact on a company's

financial performance. By focusing on financially material topics, SASB helps

companies identify and disclose information that is essential for investors to

make informed decisions.

Transparency and Comparability: SASB standards

promote transparency and comparability in sustainability reporting by providing

a consistent set of metrics and disclosures that allow investors to evaluate

companies' ESG performance across industries.

Companies that adopt the SASB framework for sustainability

reporting often experience improved investor relations, enhanced risk

management, and a stronger focus on financially material ESG issues. SASB

reporting is recognized for its industry specificity and relevance, helping

companies communicate effectively with investors and stakeholders.

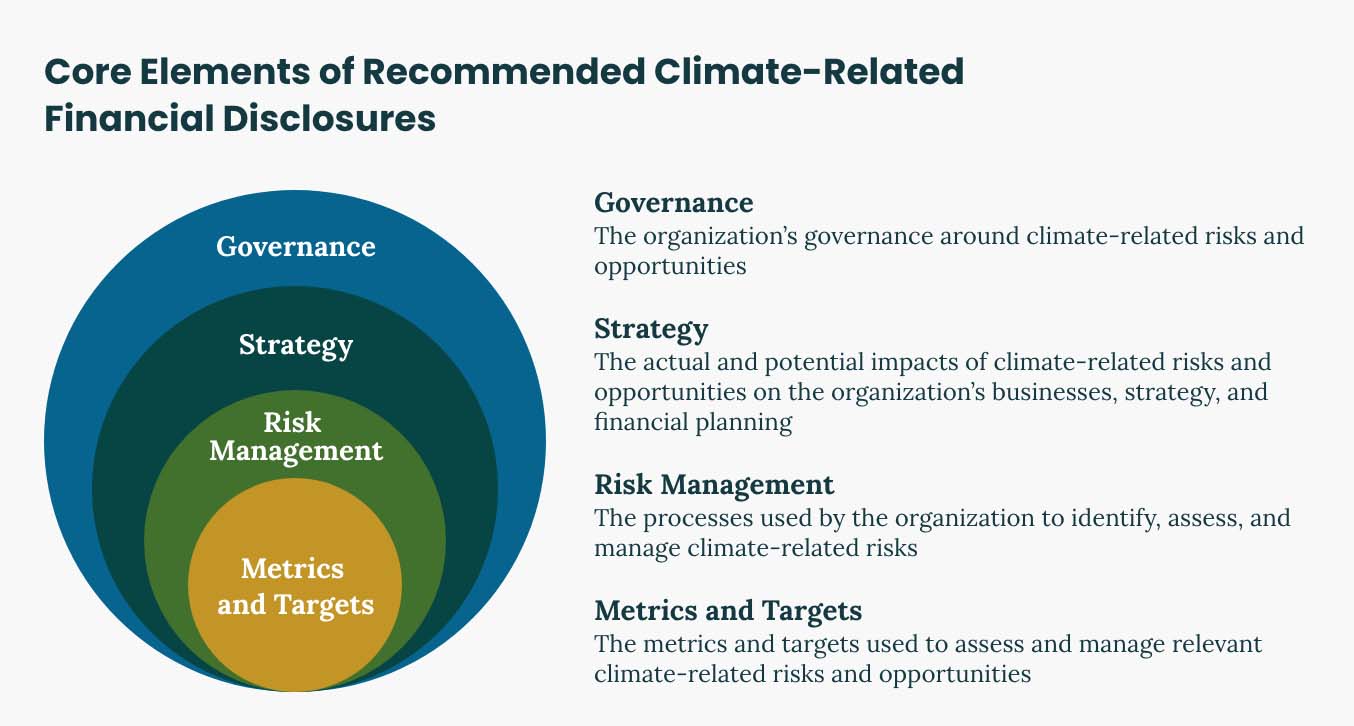

Task Force on Climate-Related Financial Disclosures (TCFD)

The TCFD framework emphasizes the importance of disclosing

climate-related risks and opportunities, helping companies assess and manage

the financial implications of climate change.

The Task Force on Climate-Related Financial Disclosures

(TCFD) was established in December 2015 by the Financial Stability Board (FSB)

to develop recommendations for voluntary climate-related financial disclosures.

Chaired by Michael R. Bloomberg, the TCFD aims to help companies assess and

disclose their climate-related risks and opportunities in a consistent and

decision-useful manner.

Key Components of the TCFD Framework:

Governance: The TCFD framework emphasizes the importance of governance around climate-related risks and opportunities. Companies are expected to disclose information on how their boards oversee and manage climate-related issues.

Strategy: Companies are required to disclose the

actual and potential impacts of climate-related risks and opportunities on

their businesses, strategies, and financial planning. This includes assessing

how different climate scenarios could affect their operations.

Risk Management: The TCFD framework expects

organizations to describe how they identify, assess, and manage climate-related

risks. This includes integrating climate risks into their overall risk

management processes.

Metrics and Targets: Companies are required to

disclose the metrics and targets used to assess and manage climate-related

risks and opportunities. This may involve reporting on greenhouse gas

emissions, energy consumption, and other relevant indicators.

By utilizing the TCFD framework, organizations can

effectively communicate their climate-related risks and opportunities,

demonstrate their commitment to climate resilience, and align their business

strategies with the transition to a low-carbon economy.

Stakeholder Engagement

Stakeholder engagement is a critical component of sustainability reporting, involving the active involvement of various individuals and groups who have an interest or stake in a company's environmental, social, and governance (ESG) performance.

Effective stakeholder engagement in sustainability reporting allows companies to build trust, transparency, and accountability with their stakeholders, leading to better decision-making and long-term value creation.

Types of Stakeholders in Sustainability Reporting

Customers:

Role: Customers are key stakeholders in sustainability

reporting as they influence purchasing decisions and brand loyalty.

Engagement Approach: Companies engage with customers through

transparent communication on sustainability practices, product sustainability

information, and feedback mechanisms.

Employees:

Role: Employees play a crucial role in implementing

sustainable practices within the organization and are valuable advocates for

sustainability initiatives.

Engagement Approach: Companies engage with employees through

internal communications, training programs, sustainability initiatives, and

feedback channels to foster a culture of sustainability.

Investors:

Role: Investors are interested in understanding a company's

ESG performance as it can impact long-term financial returns.

Engagement Approach: Companies engage with investors through

financial disclosures, sustainability reports, ESG ratings, and investor

presentations to provide insights into ESG risks and opportunities.

Suppliers:

Role: Suppliers are essential stakeholders in the value

chain and can influence a company's sustainability performance through their

own practices.

Engagement Approach: Companies engage with suppliers through

supplier assessments, sustainability requirements, supplier codes of conduct,

and collaboration on sustainable sourcing practices.

Communities:

Role: Local communities are directly impacted by a company's

operations and can provide valuable insights into social and environmental

issues.

Engagement Approach: Companies engage with communities

through community outreach programs, stakeholder consultations, local

partnerships, and community development initiatives.

Regulators and Government Agencies:

Role: Regulators and government agencies set the regulatory

framework for sustainability reporting and ESG disclosures.

Engagement Approach: Companies engage with regulators

through compliance with reporting requirements, participation in policy

dialogues, and advocacy for sustainable business practices.

NGOs and Civil Society Organizations:

Role: NGOs and civil society organizations advocate for

environmental and social issues and hold companies accountable for their

sustainability commitments.

Engagement Approach: Companies engage with NGOs through

partnerships, stakeholder dialogues, collaborative initiatives, and

transparency in sustainability reporting.

Benefits of Stakeholder Engagement

Enhanced Trust: Engaging with stakeholders builds

trust and credibility, demonstrating a company's commitment to transparency and

accountability.

Informed Decision-Making: Stakeholder feedback

provides valuable insights that inform strategic decision-making and

sustainability priorities.

Risk Management: Engaging with stakeholders helps

identify and address ESG risks, enhancing risk management practices.

Value Creation: Meaningful stakeholder engagement can

lead to innovation, improved performance, and long-term value creation for all

stakeholders.

Here are examples of stakeholder engagement initiatives that companies have implemented successfully:

Patagonia's "Worn Wear" Campaign:

Company: Patagonia, a sustainable outdoor clothing company.

Initiative: Patagonia launched the "Worn Wear"

campaign, encouraging customers to repair and reuse their old Patagonia

clothing instead of buying new items. The company hosted repair events,

provided repair guides, and offered store credit for used Patagonia clothing.

Impact: The campaign engaged customers by promoting

sustainable consumption practices, fostering brand loyalty, and highlighting

Patagonia's commitment to environmental sustainability.

Starbucks' "Grounds for Your Garden" Program:

Initiative: Starbucks implemented the "Grounds for Your

Garden" program, offering free coffee grounds to customers for use as

compost in their gardens. Customers could collect used coffee grounds from

Starbucks stores to reduce waste and promote sustainable gardening practices.

Impact: The program engaged customers by providing a

sustainable solution for coffee waste, fostering customer loyalty, and

enhancing Starbucks' environmental stewardship efforts.

IKEA's "People & Planet Positive" Strategy:

Initiative: IKEA launched the "People & Planet Positive" strategy, committing to sustainability across its operations. The strategy includes initiatives such as sustainable sourcing, energy efficiency, waste reduction, and community engagement programs.

Impact: The strategy engaged employees, customers, and other

stakeholders by promoting sustainable practices, reducing environmental impact,

and showcasing IKEA's dedication to corporate social responsibility.

Google's Sustainability Initiatives:

Company: Google, a technology company.

Initiative: Google implemented various sustainability

initiatives, such as achieving carbon neutrality, investing in renewable energy

projects, and promoting energy efficiency in its operations. The company

engages employees, customers, and communities through sustainability programs,

transparency reports, and sustainability partnerships.

Impact: Google's sustainability initiatives engage

stakeholders by demonstrating environmental leadership, fostering innovation in

sustainable technology, and contributing to a more sustainable future.

These examples showcase how companies can engage

stakeholders effectively through sustainability initiatives, environmental

programs, social responsibility efforts, and transparent communication

practices. By actively involving stakeholders in sustainability initiatives,

companies can build trust, loyalty, and long-term relationships while driving

positive social and environmental impact.

Conclusion

Sustainability reporting is no longer a niche practice; it's a crucial aspect of responsible business operations. By embracing sustainability reporting, businesses can enhance their brand reputation, improve investor relations, reduce risks, attract talent, and contribute to a more sustainable future. Stay tuned for next week's post, where we'll delve deeper into understanding key sustainability reporting frameworks!

:max_bytes(150000):strip_icc()/stakeholder-f83e2e6231b943c1a519d65610e3de35.png)

Comments

Post a Comment