What is Carbon Accounting? A Beginner’s Guide to Measuring Emissions

Climate change is no longer a distant threat—it’s happening now. From extreme weather events to rising global temperatures, the impact of greenhouse gas (GHG) emissions is undeniable.

The planet is on fire—literally.

- 2023

was the hottest year ever recorded, with global

temperatures 1.4°C above pre-industrial levels (NASA).

- By

2030, climate disasters could cost the global economy $700 billion

per year (World Bank).

- Corporations

are responsible for 70% of global emissions (CDP)—meaning

businesses hold the key to change.

Governments, investors, and consumers are demanding action, and businesses play a crucial role in reducing emissions. But here’s the challenge: How can companies cut emissions if they don’t measure them first?

The message is clear: carbon accounting isn’t

optional anymore—it’s survival.

What is Carbon Accounting?

Carbon accounting, also known as greenhouse gas (GHG) accounting, is the systematic process of measuring, tracking, and reporting an organization’s emissions in standardized units of carbon dioxide equivalents (CO₂e). Think of it as a "carbon ledger"—just like financial accounting tracks money, carbon accounting quantifies a company’s climate impact.

The Science Behind It

Governed by global standards like the Greenhouse Gas Protocol (GHGP) and ISO 14064, carbon accounting follows rigorous methodologies to:

- Set

Boundaries: Define what emissions to include (e.g., single facility

vs. entire supply chain).

- Categorize

Emissions: Classify them into Scope 1 (direct), Scope

2 (energy-related), and Scope 3 (indirect/value chain).

- Calculate

Footprint: Multiply activity data (e.g., liters of fuel used) by emission

factors (e.g., IPCC’s CO₂e per liter).

- Verify

Accuracy: Independent audits (e.g., ISO 14064-3) ensure credibility.

Why the Technical Precision Matters

- Comparability:

Standardized metrics let investors compare Apple’s emissions to

Microsoft’s.

- Regulatory

Compliance: Laws like the EU CSRD mandate

GHGP-aligned reporting.

- Science-Based

Targets: Accurate data is critical for setting Net Zero goals

(e.g., cutting emissions 50% by 2030).

Real-World Example

A shoe manufacturer might discover 60% of its

emissions come from Scope 3 (e.g., leather tanning,

shipping). Without carbon accounting, it could waste resources targeting office

electricity (Scope 2) instead of the real problem.

Beyond Corporations

Carbon accounting isn’t just for big business—it’s used by:

- Cities (e.g.,

tracking municipal waste emissions).

- Products (e.g.,

a smartphone’s lifecycle CO₂e).

- Individuals (via

apps like Mossy Earth).

Whether you’re a startup or a multinational, it’s the

foundation for reducing emissions, avoiding greenwashing, and

future-proofing your business.

Why Should Businesses Care About Carbon Accounting?

Carbon accounting isn’t just a "nice-to-have"

sustainability exercise—it’s a strategic imperative for modern

businesses. Here’s why:

1. Regulatory Compliance: Avoid Fines & Legal Risks

Governments worldwide are tightening climate regulations,

and non-compliance is becoming costly:

- EU’s

Corporate Sustainability Reporting Directive (CSRD): Requires ~50,000

companies to disclose emissions by 2025—with audit-grade accuracy or

face penalties.

- California’s

SB 253: Starting 2026, firms with >1BrevenuemustreportScope1,2,and3emissions—∗∗finesreach1BrevenuemustreportScope1,2,and3emissions—∗∗finesreach500,000/year**

for errors.

- SEC

Climate Rules (2024): Public U.S. companies must disclose material

climate risks, including emissions data.

Example: In 2023, a major European bank was

fined €4.4 million under the EU’s Sustainable Finance

Disclosure Regulation (SFDR) for misreporting emissions.

2. Investor & Stakeholder Pressure: Money Talks

Investors, shareholders, and lenders now prioritize

low-carbon businesses:

- $41

trillion in global assets are managed under ESG (Environmental,

Social, Governance) mandates (GSIA).

- BlackRock,

Vanguard, and State Street now vote against boards failing on

climate disclosures.

- 83%

of consumers prefer buying from sustainable brands (Harvard

Business Review).

Example: When ExxonMobil resisted emissions transparency, activist investors forced a board shakeup—installing three climate-focused directors.

3. Cost Savings & Operational Efficiency

Measuring emissions uncovers hidden inefficiencies that

drain profits:

- Energy

waste: A U.S. manufacturer cut $200,000/year in costs

after carbon accounting revealed inefficient HVAC systems.

- Supply

chain optimizations: Walmart reduced logistics emissions by 15%,

saving $1 billion annually (Walmart ESG Report).

- Tax

incentives: The U.S. Inflation Reduction Act (IRA) offers $369

billion in clean energy tax credits for decarbonizing.

Example: Tesla earns $1.5 billion/year selling carbon credits to polluting automakers—direct revenue from emissions tracking.

4. Competitive Advantage & Market Positioning

Early adopters outperform laggards in

growth and brand trust:

- Sustainability-focused

brands grow 5x faster than non-sustainable peers (NYU Stern).

- B2B

demand: Amazon and Apple now require suppliers to disclose emissions—no

data, no contract.

- Talent

attraction: 75% of employees prefer working for eco-conscious

employers (LinkedIn Green Skills Report).

Example: Unilever’s "Sustainable

Living" brands (e.g., Dove, Ben & Jerry’s) grew 69%

faster than others in their portfolio.

5. Future-Proofing Against Physical & Transition Risks

Climate change poses two major business risks:

- Physical

risks: Floods, fires, and droughts disrupt operations.

- Example:

In 2022, Toyota lost $350 million when a climate-linked

drought forced factory shutdowns.

- Transition

risks: Policy shifts (e.g., carbon taxes) hurt unprepared firms.

- Example: BP

wrote down $17.5 billion in assets as oil demand forecasts fell.

Companies with strong carbon accounting are 50% less

likely to face stranded assets (MSCI).

Carbon accounting isn’t about "saving the planet" alone—it’s about saving your business. From avoiding fines and pleasing investors to cutting costs and staying competitive, the ROI is undeniable.

The question isn’t "Why should we do

this?"—it’s "Can we afford not to?"

How Does Carbon Accounting Work? The GHG Protocol

At the heart of carbon accounting is the Greenhouse

Gas Protocol (GHG Protocol) – the "gold standard" for

measuring emissions. Think of it like the rulebook that helps

companies, governments, and even cities count their carbon footprint consistently

and credibly.

Developed in the 1990s by the World

Resources Institute (WRI) and the World Business Council for

Sustainable Development (WBCSD), the GHG Protocol:

✅ Defines what counts as

emissions (e.g., CO₂ from trucks, methane from landfills)

✅ Creates clear categories (Scopes 1, 2, and 3)

so everyone reports the same way

✅ Provides calculation methods (like which

emission factors to use)

It’s used by 92% of Fortune 500 companies and is the basis for regulations worldwide (like the EU’s CSRD and California’s SB 253).

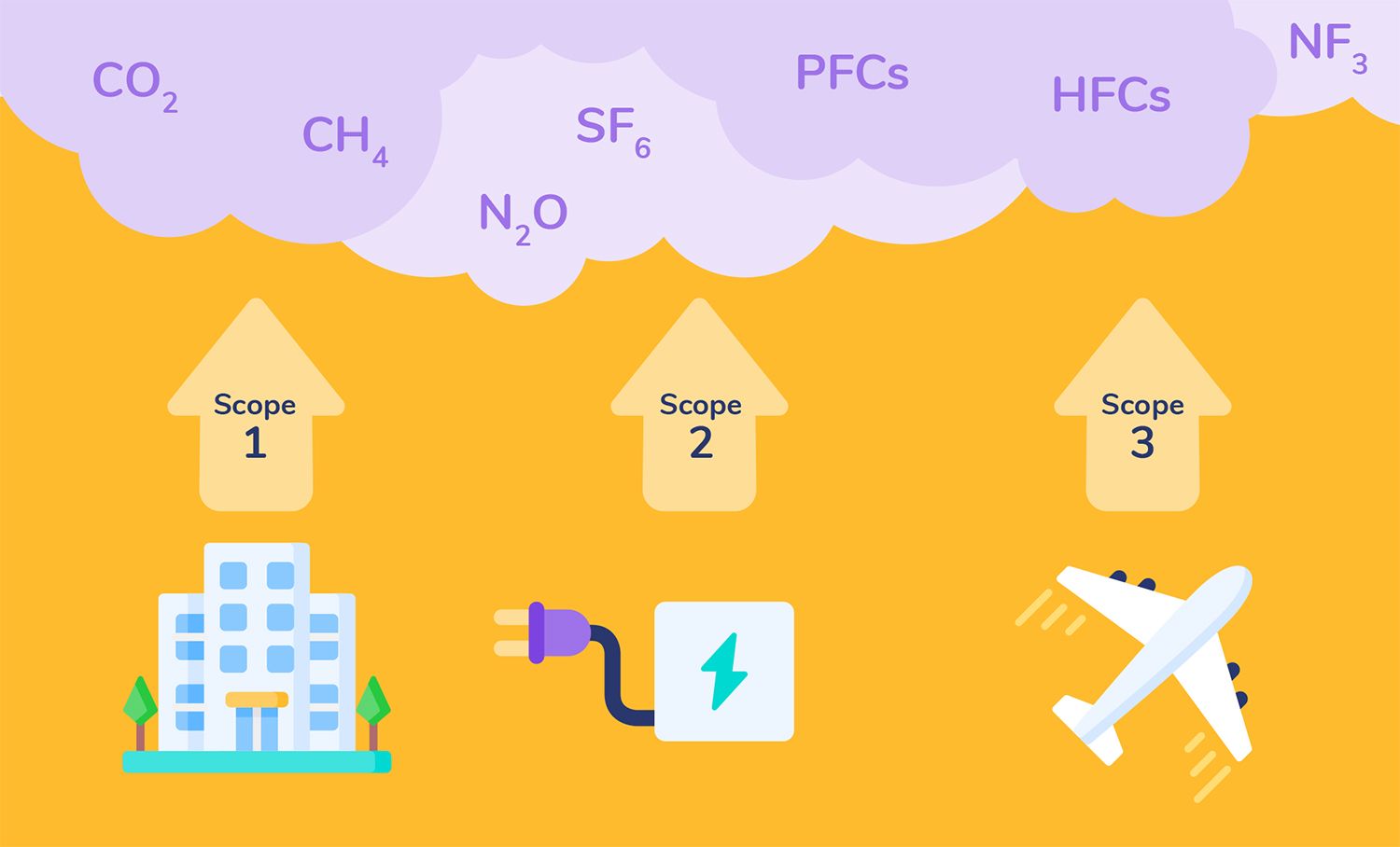

This most widely used GHG protocol classifies emissions

into three scopes:

1. Scope 1: Direct Emissions

- Emissions

from sources a company owns or controls.

- Examples:

- Burning

fuel in company vehicles.

- Gas

boilers in office buildings.

- Methane

leaks from manufacturing.

2. Scope 2: Indirect Energy Emissions

- Emissions

from purchased electricity, heat, or steam.

- Example:

- If

your office runs on coal-powered grid electricity, those emissions count

here.

3. Scope 3: Value Chain Emissions

- The

biggest (and trickiest) category—covering everything else in the supply

chain.

- Examples:

- Business

travel (flights, hotels).

- Emissions

from making the products you buy.

- Even

employee commutes!

For example: If your office uses 10,000 kWh of electricity, the GHG Protocol says:

- Grid

average (location-based): 0.5 kg CO₂e/kWh → 5,000 kg CO₂e

- Your

renewable contract (market-based): 0.1 kg CO₂e/kWh → 1,000 kg

CO₂e

This ensures a gallon of diesel in Germany counts

the same as a gallon in Japan.

When Microsoft committed to carbon negativity,

they:

- Used

GHG Protocol to calculate all scopes (discovering 75%

were Scope 3)

- Applied

its market-based method to claim 100% renewable energy

- Now require

suppliers to report using the same standard

(We’ll dive deeper into each scope in upcoming blogs—stay

tuned!)

How Do Companies Use Carbon Accounting?

Carbon accounting isn’t just about counting emissions – it’s

a strategic business tool that drives innovation, cuts costs, and

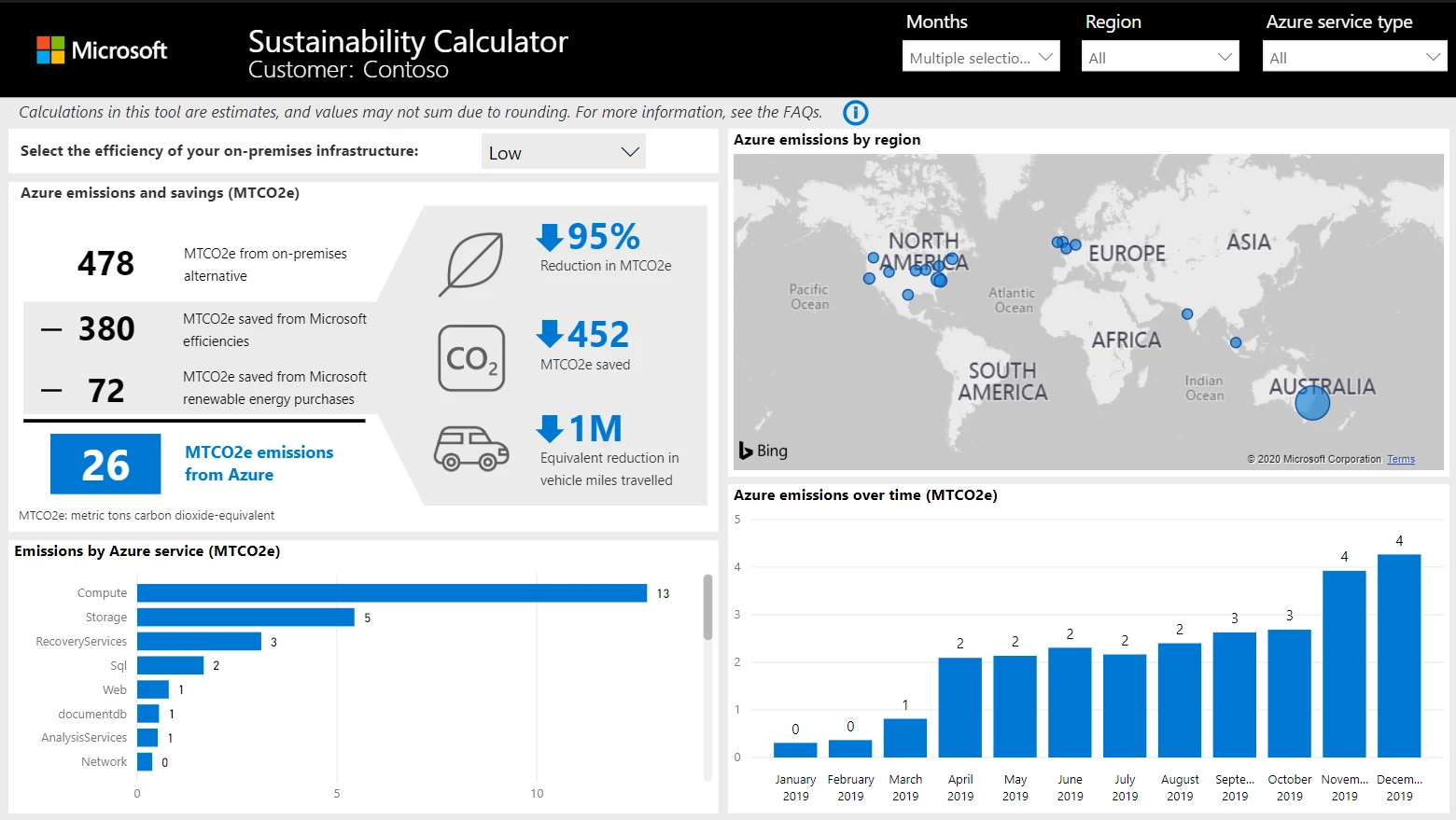

creates competitive advantage. Let’s break down how Microsoft transformed

carbon accounting from compliance exercise to core business strategy.

1. From Measurement to Action: Microsoft’s Carbon-Negative

Journey

In 2020, Microsoft made an industry-shaking

commitment: to be carbon-negative by 2030. But ambition means nothing

without execution. Here’s how they used carbon accounting to turn pledges into

results:

- Comprehensive

Baseline:

- Mapped all

emission sources across Scopes 1, 2, and 3 using GHG Protocol

standards

- Discovered Scope

3 accounted for 75% of their footprint (supply chain, product

lifecycle)

- Published

transparent, third-party verified reports – setting a new bar

for corporate accountability

- Internal

Carbon Fee ($15/ton):

- Charged

every business unit for their emissions

- Generated $100M+

annually to fund renewable energy and R&D

- Incentivized

teams to reduce first, offset last

2. Targeting the Biggest Emission Sources

Microsoft’s carbon accounting revealed two key

battlegrounds:

A. Data Centers (Scope 2) – The Energy Hungry Giants

- Problem:

Cloud computing demands massive electricity

- Solution:

- Signed 100+

renewable energy contracts (PPAs)

- Developed

AI-driven energy efficiency tools for servers

- Result: 60%

reduction in Scope 2 emissions since 2015

- Problem:

30,000+ suppliers with inconsistent reporting

- Solution:

- Required top

suppliers to disclose emissions via CDP

- Built Microsoft

Cloud for Sustainability to help vendors track carbon

- Result: 6%

annual reduction in Scope 3 despite business growth

3. Turning Carbon Data Into New Revenue

Microsoft didn’t stop at cutting emissions – they productized

their expertise:

- Launched Microsoft

Sustainability Manager

- Helps

other companies track emissions

- Now

used by 5,000+ organizations

- Integrated

carbon accounting into Azure IoT and AI tools

- Example:

Helps manufacturers optimize energy use in real-time

- $10B+

annual revenue from sustainability cloud services

4. Beyond Offsets: Pioneering Carbon Removal

While many companies rely on offsets, Microsoft invested

in permanent solutions:

- Direct

Air Capture: $1B climate fund supporting Climeworks and other tech

- AI

for Conservation: Using machine learning to track reforestation impact

- Internal

Standards: Only funding removal projects that meet strict criteria

Result: Became first megacorp to achieve

carbon-negative operations in 2022

You Don’t Need to Be Microsoft to Start

While Microsoft’s scale is unique, their strategic

approach works for any business:

- SMEs:

Use affordable tools like Watershed or Persefoni

- Manufacturers:

Focus on Scope 1 (energy/processes) first

- Retailers:

Engage suppliers through simple carbon surveys

The bottom line? Carbon accounting isn’t about guilt –

it’s about growth, resilience, and innovation. Microsoft proved that when

you measure what matters, you can change everything.

Final Thoughts: Why This Matters

Carbon accounting isn’t just for big corporations—small

businesses, startups, and even individuals can benefit. By measuring

emissions, we:

✅ Identify the biggest polluters in operations.

✅ Make smarter, eco-friendly business decisions.

✅ Contribute to a net-zero future.

The first step? Start measuring.

What’s Next?

In our next blog, we’ll break down Scope 1 emissions—how

to calculate them and real-world examples.

Got questions? Drop them in the comments—we’d love to

hear what’s on your mind!

Comments

Post a Comment